Just How to Save Money And Time With a Reputable Gas Mileage Tracker

A reliable gas mileage tracker not just automates the laborious task of documenting traveling yet likewise serves as a powerful device for making best use of tax deductions and improving expense coverage. Recognizing exactly how to choose and utilize the appropriate gas mileage tracker efficiently can make all the difference.

Advantages of Utilizing a Mileage Tracker

Tracking gas mileage successfully provides numerous advantages for both individuals and organizations. For people, a trustworthy gas mileage tracker simplifies the procedure of documenting traveling for individual or professional objectives. This can cause considerable tax reductions, guaranteeing that eligible expenditures are precisely reported and optimizing potential savings. In addition, it offers quality in budgeting for travel-related expenses, making it possible for individuals to make enlightened monetary choices.

For organizations, the advantages are multifaceted. An efficient gas mileage tracker streamlines expenditure coverage, lowering the administrative concern related to hand-operated entrance. This not just saves time however likewise decreases the risk of errors that can develop from transcribed logs or forgotten trips. Precise gas mileage monitoring sustains conformity with tax laws, protecting business from prospective audits and fines.

Secret Features to Look For

When selecting a gas mileage tracker, numerous crucial functions can substantially boost its efficiency and use. Automatic tracking capacities are necessary. This feature removes the need for manual entrance, permitting customers to focus on their jobs while the tracker records mileage effortlessly.

One more essential aspect is GPS assimilation. A tracker with general practitioner functionality provides precise location information, making certain that all journeys are logged correctly and minimizing the threat of errors. In addition, try to find an easy to use interface that streamlines navigation and information entry, making it very easy for users of all technical ability levels.

Compatibility with numerous gadgets is also crucial. A gas mileage tracker that syncs with smart devices, tablet computers, or computer systems allows customers to access their data anywhere, advertising flexibility and convenience. Durable reporting capabilities are crucial for analyzing mileage information. Look for choices that create described reports, making it easier to get ready for tax obligation reductions or expense compensations.

Leading Gas Mileage Tracker Options

Selecting the best gas visit mileage tracker can greatly boost your ability to handle travel costs properly. The marketplace offers several outstanding alternatives tailored to various requirements.

One prominent option is MileIQ, which immediately tracks your gas mileage making use of GPS technology. It features an easy to use interface and permits for very easy classification of journeys, making it excellent for both individual and business use. Another strong contender is Everlance, which not just tracks gas mileage yet additionally supplies receipt scanning and expense tracking, providing an extensive service for expense management.

For those looking for a complimentary alternative, Stride is an outstanding option. It permits users to log miles by hand while also offering understandings right into possible tax obligation deductions. TripLog stands out for its advanced coverage functions and compliance with internal revenue service guidelines, making it a solid choice for business professionals.

Last But Not Least, Zoho Expenditure integrates gas mileage monitoring with broader expense monitoring devices, best for business wanting to streamline their economic processes. Each of these gas mileage trackers brings special features to the table, making sure that individuals can find the excellent fit for their demands.

Exactly How to Effectively Make Use Of a Gas Mileage Tracker

To make best use of the benefits of a mileage tracker, customers should first acquaint themselves with its features and capabilities. Understanding exactly how to input read what he said information, classify journeys, and access reporting choices is crucial for effective usage - best mileage tracker app. The majority of mileage trackers use automated monitoring options through GPS, which permits individuals to capture journeys properly without manual entry

Individuals must ensure that the tracker is set to tape-record their automobile kind and objective of traveling, whether for organization, individual, or charity. This categorization assists in much better coverage and makes certain conformity with tax obligation guidelines. Routinely assessing and upgrading gas mileage access is critical to keeping precision and efficiency.

Furthermore, individuals must discover integration capabilities with accountancy or cost monitoring software program, which can simplify the procedure of monitoring expenses and streamlining tax obligation prep work. Establishing tips for regular reporting can help customers remain organized and guarantee no trips are ignored.

Tips for Maximizing Savings

Efficient usage of a gas mileage tracker not only enhances record-keeping yet likewise offers possibilities for considerable savings. To make best use of these financial savings, begin by picking a gas mileage tracker that integrates effortlessly with your monetary software. This assimilation assists streamline expenditure reporting, guaranteeing you capture important source every eligible reduction.

Next, maintain constant and accurate documents. Log your mileage promptly after each journey to avoid errors. Classify your trips successfully, differentiating in between service and personal traveling, as only business miles get approved for deductions.

Utilize the coverage features of your tracker to examine your travel patterns. This insight can disclose unnecessary journeys that can be minimized or eliminated, consequently lowering gas prices. Additionally, think about incorporating tasks into single journeys to maximize mileage usage.

Remain informed regarding tax obligation regulations pertaining to gas mileage deductions. The IRS updates these prices each year, so guarantee you apply the appropriate numbers to your documents.

Lastly, evaluate your gas mileage logs frequently to recognize possible financial savings possibilities. This proactive method not just improves economic monitoring but also encourages extra reliable travel methods, inevitably resulting in raised cost savings in time.

Conclusion

Finally, leveraging a dependable mileage tracker provides significant advantages in time and cost savings via automation and accurate trip logging. Important features such as GPS integration and durable coverage improve effectiveness and promote conformity with tax obligation regulations. The assimilation with monetary software application optimizes expense monitoring. By making use of these tools properly, individuals and organizations can maximize savings and simplify their traveling documents processes, eventually adding to boosted budgeting and economic planning.

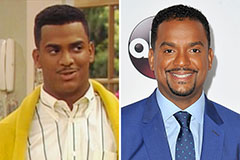

Alfonso Ribeiro Then & Now!

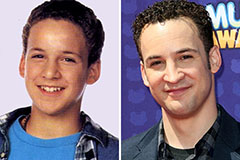

Alfonso Ribeiro Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!